Translated using ChatGPT service.

In August, consumer prices declined, but the decrease was one of the most moderate in recent years, reflecting a weaker influence of seasonal factors.

According to the latest data published by the Central Statistical Bureau, in August 2025, compared to July, the consumer price level fell by 0.2 %. Prices for goods decreased by 0.4 %, while services increased by 0.3 %.

August typically sees price reductions due to seasonal factors. This year, monthly price changes were in line with seasonal patterns, but the decline was more moderate than in the previous two years. Inflation in August was mainly influenced by cheaper alcoholic beverages, falling fuel prices due to lower global oil prices, a smaller-than-usual decline in food prices, and increases in the prices of personal care products, electricity, and services. Food price dynamics were shaped both by rising world food prices for certain products and by local seasonal and weather factors, which reduced supply and slowed the typical seasonal price decline. While food prices decreased in Latvia in August, they rose in Estonia and remained unchanged in Lithuania. This difference among the Baltic states indicates relatively lower price pressures in Latvia and a possible positive effect of the memorandum concluded at the end of May, which helped reduce prices of essential goods even in August. Prices for the products included in the memorandum fell slightly more than the overall food category. At the same time, the usual seasonal price decline for clothing and footwear was the smallest in recent years and had only a minor effect on the overall price level.

In the goods sector, the largest downward influence in August came from alcoholic beverages, which fell by 3.1 %, reducing the overall consumer price level by 0.15 percentage points. This was the fastest monthly decline for alcoholic beverages since March 2014, largely driven by retailers’ responses to reduced sales risks following the sales restrictions introduced on August 1, making base price adjustments to maintain sales volumes. Prices fell across all types of alcoholic beverages, with the largest effect from strong alcoholic drinks and beer.

Fuel prices also had a significant downward impact, falling by 2.1 % and lowering the overall consumer price level by 0.1 percentage points. Gasoline prices decreased the most.

Oil prices declined in August. The average monthly price of Brent crude fell by about 3 % compared to July, and by the end of the month, the price was 6 % lower than at the end of July. Price dynamics were influenced by OPEC+ decisions to significantly increase production, fully reversing the 2023 cut, and rising concerns about a global oil surplus, which generally kept price pressure low. Most of the month, Brent traded between $65–68 per barrel, dropping to nearly a three-month low. Temporary upward impulses were caused by U.S. inventory reductions and increasing geopolitical tensions related to the Russia–Ukraine conflict and U.S.–India trade disputes. However, these supporting factors were outweighed by signals of weaker demand in China, the end of the summer driving season in the U.S., and forecasts of market surplus until 2026. Investor sentiment remained cautious in August, with the market focusing more on supply risks than on demand support.

Food and non-alcoholic beverage prices fell by 0.3 %, reducing the overall consumer price level by 0.1 percentage points. Traditionally, food prices drop sharply in August, but this year the decline was more moderate. The largest downward effects were seen for fresh vegetables, fresh fruits, potatoes, dried, salted, or smoked meat, and milk, while the biggest upward effects were observed for cheese, curd and other dairy products, bread, and chocolate.

Globally, food prices remained mostly unchanged during the month, but compared to August 2024, they increased by 6.9 % year-on-year. Declines in cereal and dairy prices were offset by increases in meat, sugar, and vegetable oil prices. The vegetable oil price index reached its highest level since July 2022, driven by rising prices for palm, sunflower, and rapeseed oils due to strong import demand and declining supply, outweighing the slight drop in soybean oil prices caused by the expected abundant 2025/2026 global soybean harvest. Meat prices reached record levels in August. Increases were driven by rising beef and lamb prices, which outweighed stable pork prices and declining poultry prices. Beef prices hit all-time highs due to strong demand from the U.S. and China, while lamb prices rose for the fifth consecutive month due to limited supply from Oceania. Pork prices remained stable, while poultry prices fell due to large supply in Brazil and restrictions on import recovery by some trade partners. Sugar prices rose slightly after five months of decline due to concerns over Brazil’s crop prospects and rising global import demand, particularly from China. However, favorable weather and expected higher yields in India and Thailand limited the increase. Dairy prices fell fastest in August, marking the second consecutive month of decline, driven by lower prices for butter, cheese, and whole milk powder due to high availability and weak demand, especially in Asian markets. Skimmed milk powder prices rose due to limited supply and steady demand in Southeast Asia. Cereal prices fell for the fourth consecutive month. Wheat prices continued to decline due to abundant harvests and weak import demand, especially in Asia and North Africa, while corn prices rose for the third consecutive month due to heat concerns affecting EU crops and higher demand in the U.S. for feed and bioethanol.

The largest upward impact in August came from personal hygiene and beauty products. Prices increased by 5.4 % after promotions ended, raising the overall price level by 0.1 percentage points.

Notable price increases were also observed for housing-related energy, which together raised the overall consumer price level by 0.1 percentage points. Electricity prices increased the most—by 2.5 %—driven by higher exchange prices, which increased tariffs linked to electricity market prices. This was mainly influenced by lower electricity generation from renewable sources and reduced availability of nuclear power plants in the Nordic countries. Natural gas prices remained unchanged, while heating energy fell by 0.5 % and solid fuels by 0.3 %.

Service prices rose by an average of 0.3 % in August, contributing 0.1 percentage points to the overall price level. Within services, the largest upward influence came from comprehensive telecommunication services and housing rent increases. Increases in leisure-related services—accommodation, food, and comprehensive recreation services—also had a notable effect. The largest downward influence on overall prices came from declining passenger air transport prices.

Price fluctuations in other goods and services had no significant impact on the overall price level during the month.

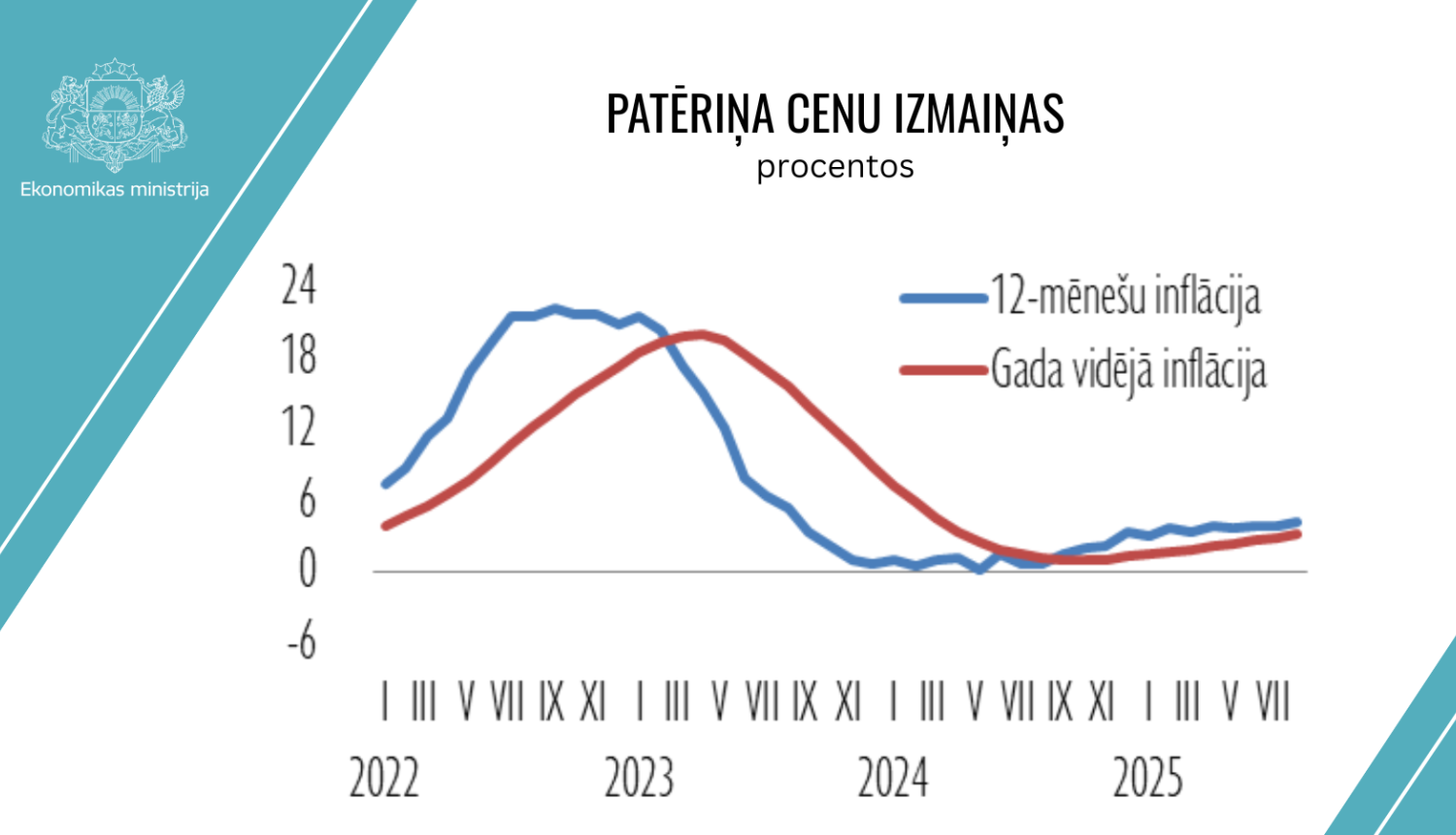

In August 2025, compared to August 2024, consumer prices increased by 4.1 %, and the annual average inflation was 3.2 %.

Going forward, price changes in Latvia will continue to be significantly influenced by global price fluctuations and world economic developments, particularly geopolitical developments and their impact on energy and food prices, as well as U.S. tariff policies. Average annual inflation in 2025 is expected to be around 3.5 %.