In November, the decline in consumer prices followed the usual seasonal patterns, typically driven by lower service costs. However, this year, the price drop was particularly reinforced by food prices, which in November usually remain stable or even rise. This unusual decrease in food prices further eased inflationary pressures.

According to the latest data published by the Central Statistical Bureau (CSB), in November 2025, the consumer price level fell by 0.3% compared to October. Prices for goods decreased by 0.1%, while service prices fell by 0.7%.

November traditionally sees a price decline or very low inflation, mainly due to seasonal factors. This year, prices fell for the first time since 2020, with dynamics largely resembling the pre-COVID-19 and pre-energy crisis period, when November price changes usually ranged between -0.5% and +0.2%. The decline this year was primarily driven by a significant drop in food prices and lower prices for services related to the end of the tourist season—particularly air travel, accommodation, and leisure services. In contrast, prices for personal care products rose.

Traditionally, November sees rising food prices, especially due to seasonal increases in fresh vegetable costs, which this year remained the main upward factor. Nevertheless, despite this seasonal effect, overall food prices decreased in November, and at a faster pace than any other November since 2013, indicating an unusually strong downward trend. Prices of products in the low-price basket remained mostly stable over the month, as the increase in vegetable prices limited their faster decline. Compared to May 2025, these prices have fallen by 0.8%. Overall, the decline in food prices confirms that the low-price basket initiative continues to help ease food inflation. Moreover, compared to Estonia and Lithuania, food prices in Latvia have fallen more sharply since the memorandum’s introduction, indicating a relative reduction in price pressures and the potential positive impact of the memorandum.

In the goods sector, the largest downward effect in November came from falling food prices. Prices for food and non-alcoholic beverages fell by 0.5%, reducing the overall consumer price level by 0.1 percentage points. The decline was mainly driven by lower prices for fresh fruits, milk and dairy products, meat, coffee, and fruit and vegetable juices. The only significant upward pressure came from the seasonal price rise for fresh vegetables.

Globally, food prices fell for the third consecutive month in November, by 1.2%, and were 2.1% lower than a year ago. The decline was driven by falling prices for sugar, dairy products, vegetable oils, and meat, which outweighed increases in grain prices. Sugar prices fell to their lowest level since December 2020 for the second month in a row, due to expectations of sufficient supply: record-high sugar production in Brazil and good harvest prospects in India and Thailand. Dairy prices fell for the fifth consecutive month, driven by increased supply of milk and milk powder in the EU and New Zealand, large stocks, and weaker demand in several Asian markets. Butter and whole milk powder prices fell the fastest. Vegetable oil prices also decreased to a five-month low, driven by lower palm, rapeseed, and sunflower oil prices, aided by good harvest forecasts and seasonal supply increases. Only soybean oil prices rose slightly, due to biodiesel production demand. Meat prices fell for the second consecutive month, with pork and poultry prices declining. Pork prices in Europe dropped due to ample supply and weak Chinese import activity, while poultry prices fell due to strong competition from Brazilian exporters after several countries lifted avian flu trade restrictions. Beef prices remained stable, while lamb prices rose due to strong import demand. In contrast, grain prices rose in November, mainly driven by wheat and corn price increases, influenced by potential Chinese demand for US deliveries, concerns about the Black Sea region, and challenging harvest conditions in South America.

The largest upward effect in November came from personal care and beauty products, which rose 3.1% after promotional discounts ended, pushing up the overall consumer price level by 0.1 percentage points.

Fuel prices saw a slight increase of 0.6% in November, but this had little impact on the overall consumer price level. Price increases were similar for diesel and gasoline.

Globally, crude oil prices fell overall in November. Brent crude fluctuated around $62–65 per barrel and recorded a very slight monthly decline of about 0.5%, ending the month 3% lower than at the end of October. Price dynamics were influenced by ample global supply, slower demand growth, and uncertainty regarding possible geopolitical solutions. At the beginning of the month, prices fell due to concerns over a global supply surplus: rising US inventories, increased production by OPEC+ and non-OPEC countries, and weaker industrial and demand indicators in major oil-consuming countries. Downward pressure was further reinforced by reports of cheaper Saudi oil offers to Asian markets and signals of market oversupply. Mid-month, volatility increased as prices temporarily rebounded following new sanctions on Russian oil companies and supply disruptions, raising fears of potential supply shortages. However, this trend was short-lived—OPEC and IEA’s latest forecasts of a persistent market surplus and continued production growth in the US, Canada, and Brazil quickly dampened the recovery. By the end of the month, prices came under renewed pressure as investors evaluated potential progress in resolving the Ukraine-Russia conflict. A scenario in which sanctions on Russia’s oil sector are lifted could increase supply in an already oversupplied market, further weakening demand-supply prospects. Meanwhile, concerns about global oversupply continued, especially ahead of the OPEC+ meeting, as the organization planned only to maintain the scheduled production increase, without stricter restrictions that could reduce market surplus.

Service prices fell by an average of 0.7% in November, lowering the overall price level by 0.2 percentage points. The largest downward effect came from falling air passenger transport prices, due to the end of the season, lower demand, and widespread promotions. Additional reductions were seen in accommodation and package leisure services, typical after the peak tourist season when guest flow decreases significantly. The largest upward effect on the overall price level came from social protection services, mainly due to increased costs for elderly care and long-term social care in nursing homes.

Price fluctuations in other goods and service groups had little impact on the overall price level in November.

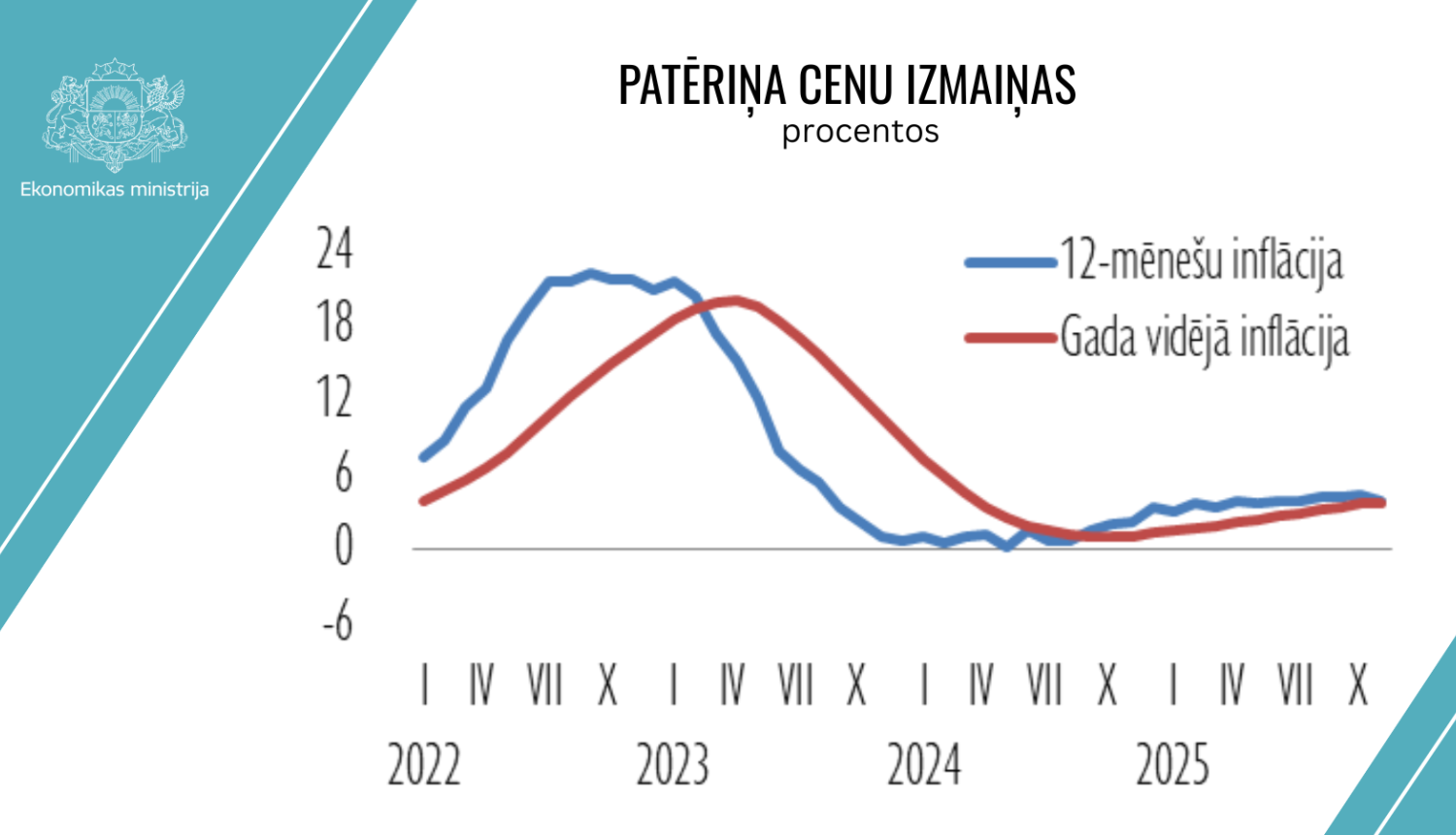

In November 2025, compared to November 2024, consumer prices rose by 3.8%. The average annual inflation rate was 3.7%.

Going forward, price changes in Latvia will continue to be significantly influenced by global price fluctuations and the world economic situation, especially geopolitical developments and their impact on energy and food prices. The average annual inflation for 2025 is expected to remain around 3.7%.