Translated using ChatGPT service.

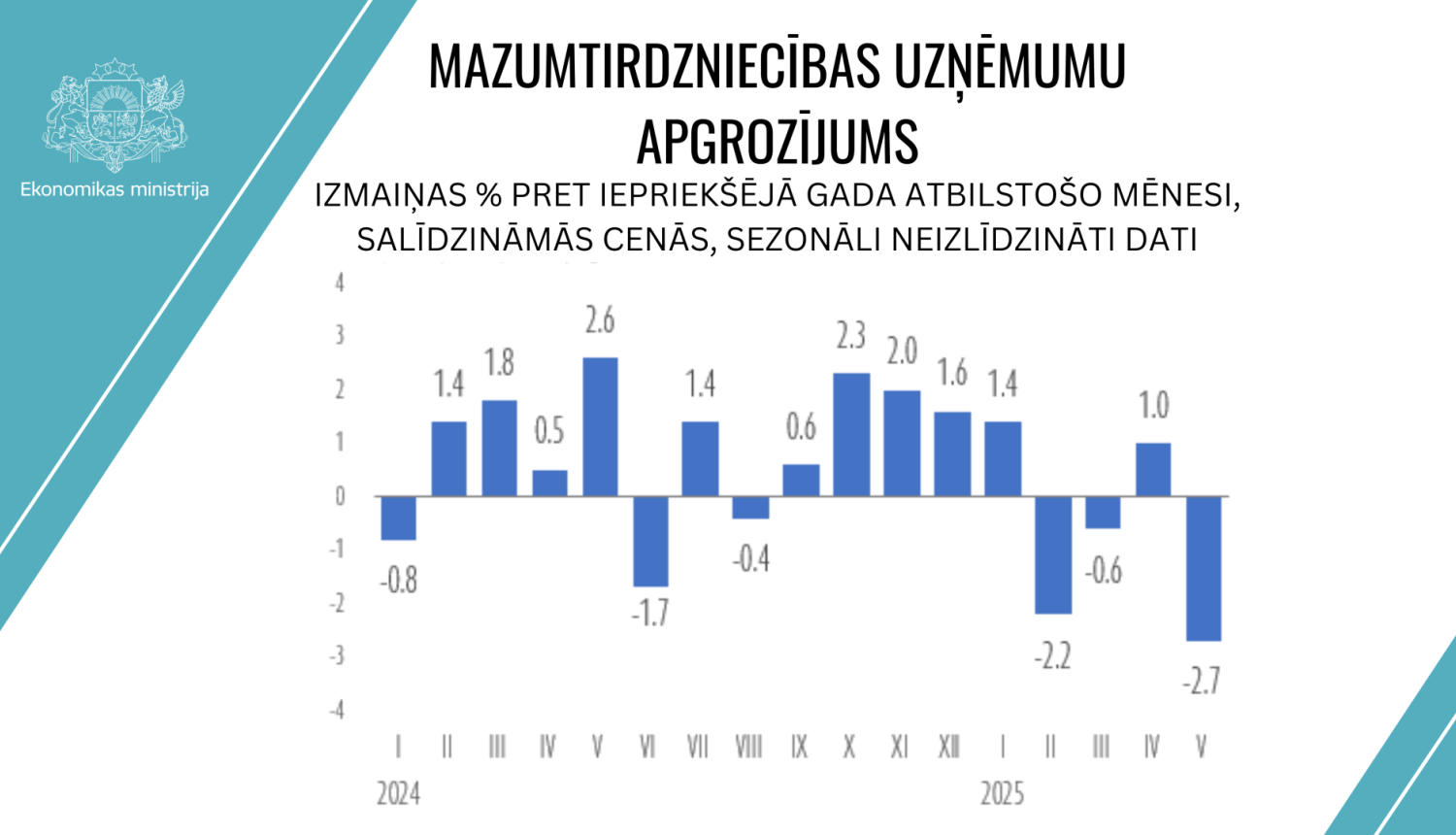

After an increase in April this year, retail trade turnover in May 2025 declined again, primarily due to a high comparison base – in May 2024, there was a sharp increase in non-food and fuel sales – as well as the relatively rapid rise in food prices.

In the coming months, retail turnover is expected to gradually stabilize and return to growth – consumer activity will be moderately supported by rising wages, influenced by recent tax changes, as well as the gradual decrease in interest rates. An additional positive effect may come from the recently signed memorandum on reducing prices for essential food products, which could free up more funds for other daily expenses and boost consumption beyond the food segment. At the same time, it must be acknowledged that high price levels continue to strain household budgets, thus limiting a more rapid increase in household consumption.

In May 2025, compared to the same period of the previous year, the total turnover of retail trade enterprises at constant prices decreased by 2.7% (based on unadjusted data). While in May of the previous year food retail turnover remained unchanged, this May saw a sharp decline in this segment. Sales of non-food products and fuel also declined, although at a more moderate pace. Retail trade volume also decreased on a monthly basis – in May, compared to April, it dropped by 0.7% (based on seasonally adjusted data), with decreases in both food and non-food product turnover.

In May, compared to the same month of the previous year, non-food retail turnover fell by 1.3%. The sharpest decline was observed in the retail of clothing, footwear, and leather goods (by 12.4%) and in sports goods and toys (by 6%). More moderate declines were seen in the sales of textiles, carpets, floor coverings, wallpaper, furniture, lighting equipment, and other household goods (by 2.7%), books, newspapers, stationery, audio and video recordings (by 1.6%), and pharmaceutical and medical goods (by 1.6%).

On the other hand, retail turnover in May, compared to the same period of the previous year, increased the most in the sale of information and communication technology equipment (by 7.5%), household electrical appliances in specialized stores (by 7.1%), and flowers, plants, seeds, fertilizers, pets, and pet food (by 7%). There was also notable growth in the retail of cosmetics and toiletries (by 5.8%) and in watches, jewelry, and other unclassified new goods (by 4.6%). A slight increase was observed in the sales of metal goods, tools, building materials, and plumbing (by 0.7%).

Food retail turnover decreased significantly year-over-year – by 4.8%, largely due to the high base in May of the previous year when food retail turnover decreased only by 0.3%. Food prices continue to rise, thus impacting the turnover of food goods.

By type of retail outlet, turnover declined in May compared to the same period of the previous year in retail at stalls and markets (by 12.3%), and continued to fall in other retail outside of shops, stalls, and markets – by 11.9%. There was a slight drop in retail by mail or online (by 1.2%).

Fuel retail turnover at fuel stations in May fell by 2.6% compared to May 2024, despite lower fuel prices compared to the previous May. This was largely due to the high base in May 2024, when fuel sales surged.

Overall, in January–May of this year, retail turnover decreased. Compared to January–May 2024, it was 0.7% lower. This was largely driven by a 3.3% drop in food retail turnover. Non-food retail turnover increased by 1.6%, while fuel retail turnover declined by 1.6%.