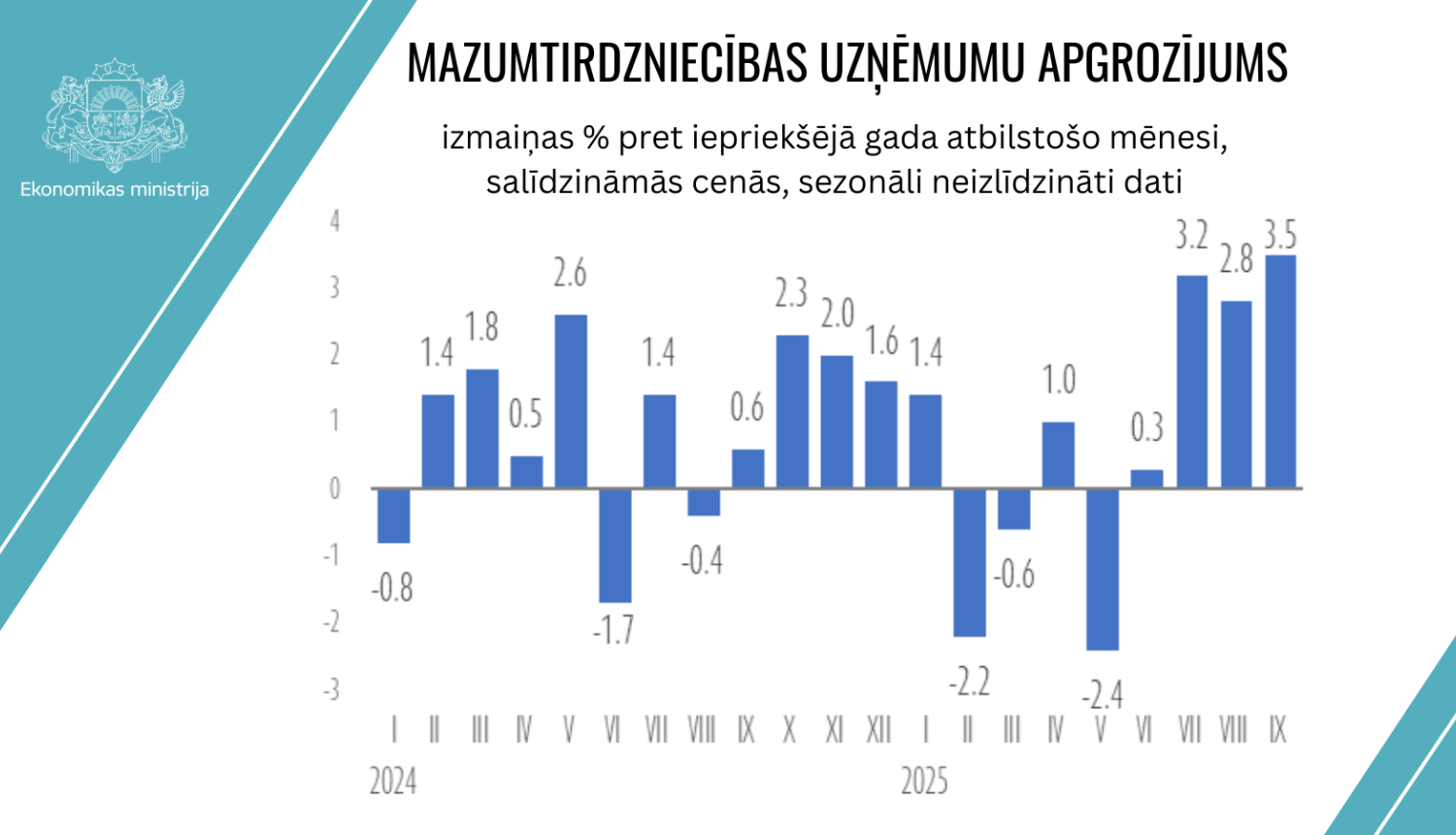

In September this year, compared to the same month last year, retail turnover increased. The growth was primarily driven by a rise in non-food product sales, which continued at a similar pace as in the previous two months, while a significant contribution also came from higher fuel retail sales.

The growth figures were partially influenced by a relatively low base, as retail turnover in September 2024 had been particularly low.

Over the year, the total retail turnover of companies at constant prices increased by 3.5% according to unadjusted calendar data, and by 2.6% according to seasonally adjusted calendar data.

A slight decline in retail volume was observed on a monthly basis. In September, compared to August, retail turnover fell by 0.7% (seasonally adjusted data), due to a decrease in non-food goods, which likely reflects a stabilization of consumption after several months of rapid growth in non-food sales, with consumers becoming more cautious with larger purchases at the start of autumn.

In the coming months, retail turnover is likely to remain volatile, but the overall trend is expected to continue in a moderate growth direction. In September, annual growth was supported by an increase in non-food sales, alongside a notable rise in fuel retail turnover this month. In the food segment, the decrease in turnover was minor, supported by steady supermarket consumption and lower prices for essential goods. Over the year, consumption continues to be supported by improved purchasing power and a more stable consumer sentiment, although high price levels and cautious spending will remain key factors limiting faster growth in consumption.

In September, compared to the same month last year, non-food retail turnover rose by 6.4%, with growth observed in almost all major non-food product categories. The fastest growth was recorded in the sale of watches, jewelry, and other miscellaneous new goods (up 18.2%), as well as in textiles, carpets, floor coverings, wallpapers, furniture, lighting, and other household items (up 17.1%). Strong increases were also seen in sports goods and toys retail (16.0%), pharmaceutical and medical products (12.1%), flowers, plants, seeds, fertilizers, pets and pet food (12.0%), and household appliances in specialized stores (11.5%). Higher turnover was also recorded in cosmetics and toiletries (6.7%) and in books, newspapers, stationery, and audio/video products (4.4%), while moderate growth was observed in clothing, footwear, and leather goods (2.4%), information and communication technology equipment (2.2%), and metal products, tools, construction materials, and plumbing retail (0.6%).

Food retail turnover decreased slightly year-on-year in September, by 0.4%, mainly due to a sharp decline in specialized food stores. In contrast, supermarket sales increased, and given the low comparison base in September 2024, the overall decrease remained very modest. Consumers still preferred larger stores with a wider range of goods, while sales in specialized food stores continued to decline.

Fuel retail turnover at gas stations increased significantly in September – by 3% compared to September 2024, even though fuel prices were slightly higher than last year. This growth was likely driven by increased vehicle traffic, more active economic activity after the summer season, and higher domestic mobility and freight transport compared to the previous year.

By type of sales outlet outside stores, turnover growth in September compared to the same period last year was observed in market and stall retail (5.8%), mail-order and online retail (7.3%), and other retail outside stores, stalls, and markets (6.9%).

In the first nine months of this year, compared to January–September 2024, retail turnover was 0.8% higher. This was largely driven by a 3.8% increase in non-food retail turnover. Food retail turnover decreased by 2.5%, and fuel retail turnover decreased by 0.6%.