Amid strong external demand, manufacturing output in September 2025 recorded the fastest year-on-year growth since June 2022, continuing an upward trend for the seventh consecutive month.

Positive contributions to growth are also being provided by domestically oriented sectors, driven by factors such as household purchasing power, including wage increases, tax changes, price stabilization, and other influences.

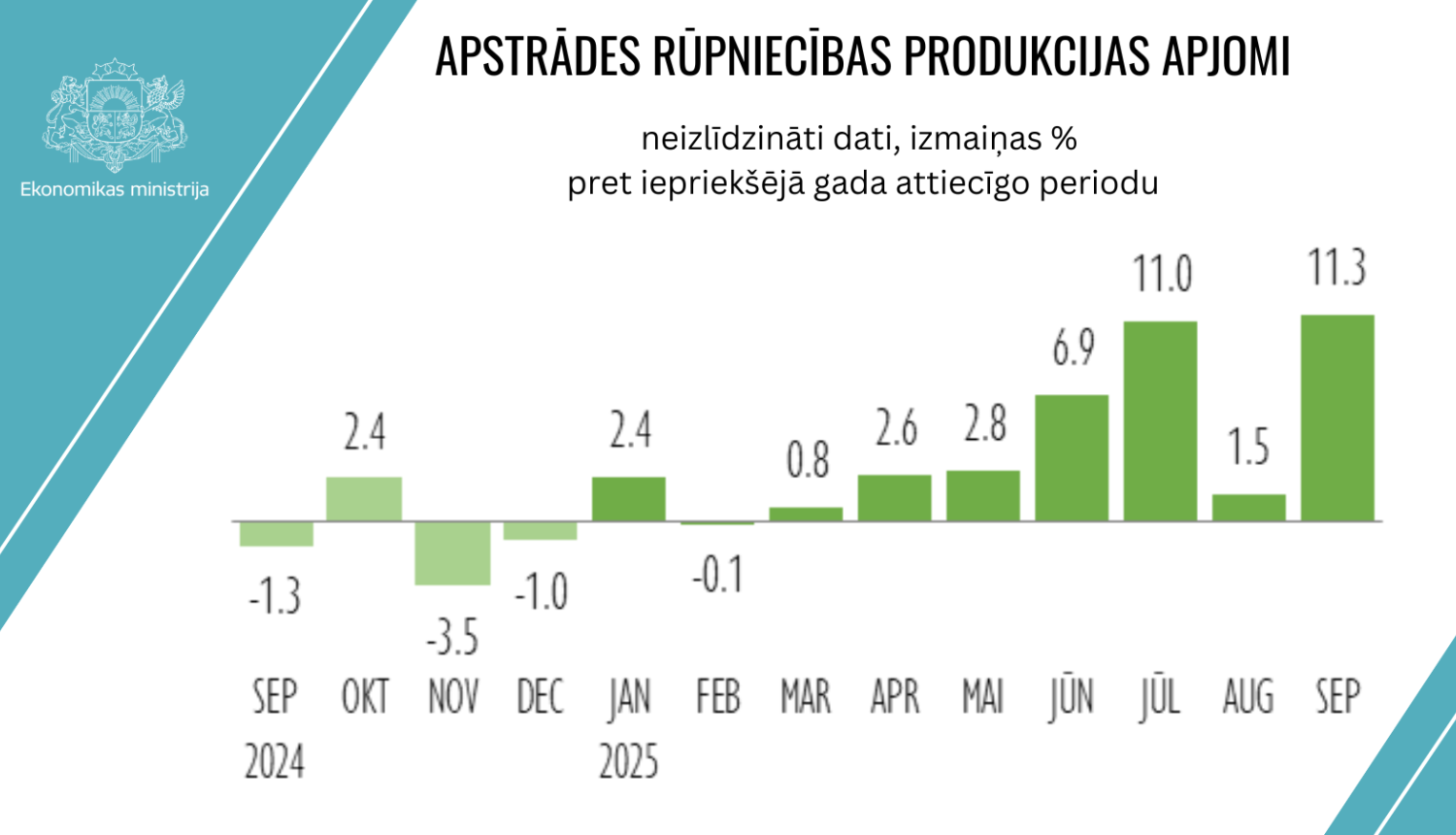

Compared to September 2024, unadjusted data show manufacturing production volumes increased by 11.3%, while calendar-adjusted data indicate a slightly more moderate increase of 8.5%.

Overall, during the first three quarters of 2025, unadjusted data show that manufacturing output was 4.5% higher than the previous year.

In September, the most significant positive impact on manufacturing growth, for the fourth consecutive month, came from the two largest subsectors: wood processing (+12.8%) and food production (+13%). Production volumes also increased in finished metal products (+16%), automobiles and trailers (+37%), and computers, electronic and optical equipment (+14.5%).

In current prices, manufacturing turnover rose sharply by 14.1% year-on-year in September. Growth was stronger in exports (+16.1%) than in the domestic market (+10.5%), with particularly significant increases in the turnover of wood processing and food products.

It is expected that stable growth in manufacturing will continue in the final quarter of the year, with total annual output significantly exceeding 2024 levels. Manufacturing growth will continue to be supported by external demand and increasing export volumes.

At the same time, positive industrial development is constrained by geopolitical uncertainty and potential U.S. import tariffs, which could affect the competitiveness of Latvian exporting companies. Overall, although forecasts are positive, the sector will need to maintain flexibility and the ability to adapt to changing global trade conditions. Challenges will persist for companies whose operations are still linked to Russia and other CIS markets, as these companies will need to continue restructuring trade directions and seek new supply and sales markets.