Translated using ChatGPT service.

Protams! Šeit ir Jūsu teksts iztulkots angļu valodā:

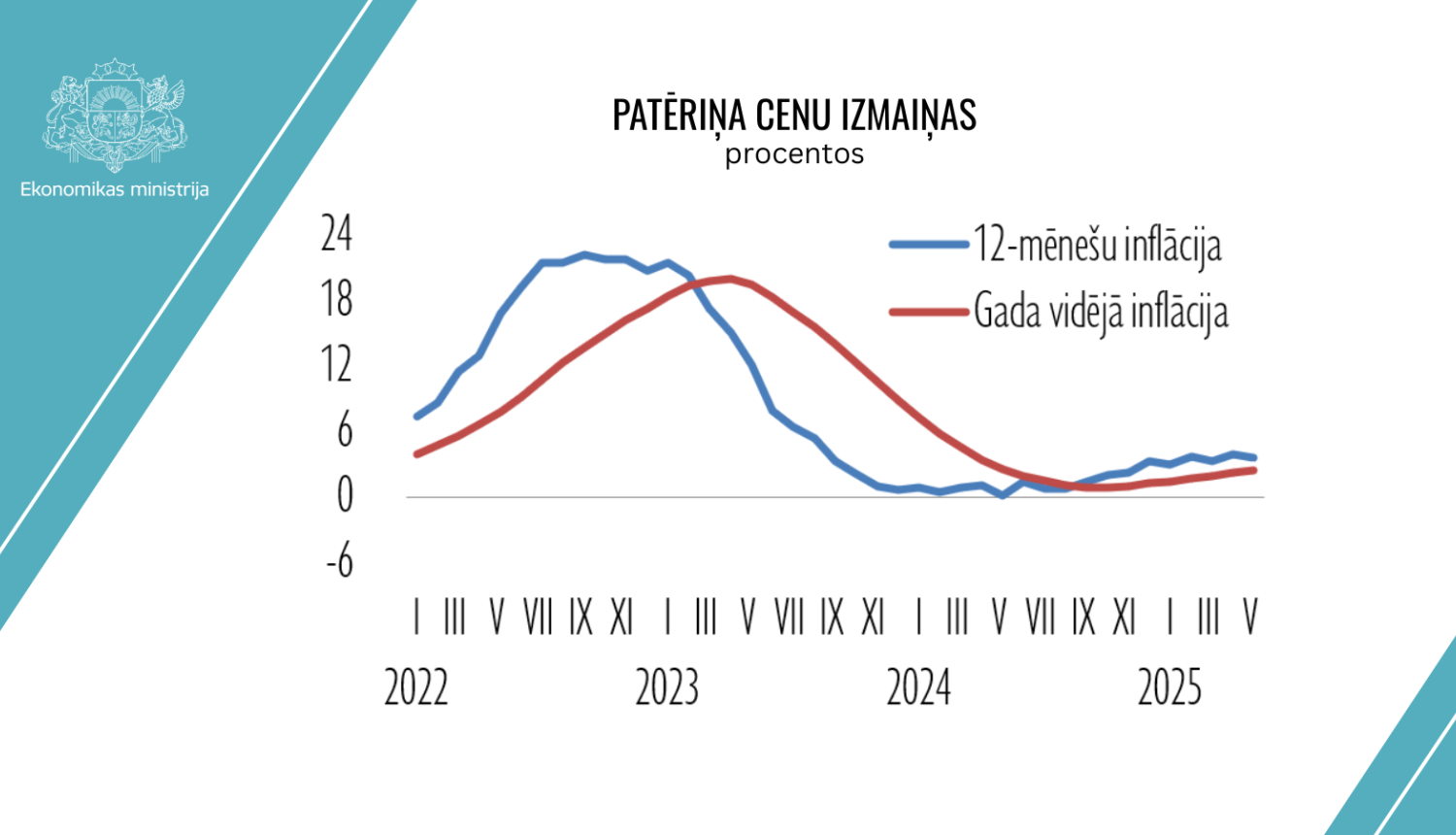

Inflation slows down in Latvia in May; annual increase expected

After eight consecutive months of steady growth in consumer prices, inflation in Latvia showed signs of slowing in May 2025. Going forward, price changes in Latvia will be significantly influenced by global price fluctuations and economic developments, particularly the geopolitical situation and its impact on energy and food prices, as well as U.S. tariff policy. The average annual inflation rate in 2025 is expected to be higher than in 2024 and could exceed the 3% mark.

According to the latest data published by the Central Statistical Bureau, in May 2025, compared to April, the consumer price level decreased by 0.1%. Prices for goods fell by 0.2%, while prices for services increased by 0.1%.

Typically, May sees either a slight increase or slight decrease in prices. This year, price changes followed a pattern characteristic of the month. However, a decrease in consumer prices in May was last observed only during the COVID-19 crisis in 2020 and before that in 2014. Therefore, the decline in consumer prices this May signals a trend of inflation slowing. This was mainly driven by a drop in fuel prices, prompted by a sharp decline in global oil prices. Nevertheless, food prices remained a significant factor, continuing their upward trend in May. Food prices have long been one of the main contributors to inflation in Latvia.

The largest downward effect in May came from falling fuel prices – a drop of 4.8% – which reduced the overall consumer price level by 0.3 percentage points. Prices decreased across all fuel types, with the steepest decline seen in diesel.

The average oil price in May fell significantly for the fourth month in a row. The average monthly price of Brent crude dropped by about 4% compared to April, although it rose 1.2% by the end of the month. Oil price fluctuations in May were mainly influenced by OPEC+ decisions to increase production, geopolitical risks, and the global economic outlook. At the beginning of the month, oil prices were close to a four-year low (around USD 60 per barrel) due to OPEC+ countries, including Saudi Arabia and Russia, announcing a production increase of 411,000 barrels per day in June – more than previously expected. Tensions in U.S.–China trade relations also raised concerns about slowing global growth and weakening energy demand. However, by the end of the month, oil prices rose again to around USD 65 per barrel, supported by a U.S.–China agreement to drastically reduce tariffs for at least 90 days and a U.S. presidential announcement to delay new tariffs on European goods until July 9, reducing fears of a trade war. Geopolitical risks related to the Middle East and the war in Ukraine also supported oil prices, as concerns about supply disruptions grew.

The largest upward pressure in May came from rising food prices. Prices for food and non-alcoholic beverages rose by 0.3%, increasing the overall consumer price level by 0.1 percentage points. Although the food price increase in May was uncharacteristically modest, it was steeper than in the same month in the previous two years. The biggest contributors to price growth were coffee and meat products, while fresh vegetables had the strongest downward effect.

Globally, food prices declined in May after three consecutive months of increases – by 0.8% month-on-month. However, compared to May 2024, food prices were up by 6% year-on-year. Declines in the prices of vegetable oils, sugar, and cereals outweighed increases in meat and dairy. Vegetable oil prices dropped the most, driven by falling prices of palm, rapeseed, soybean, and sunflower oils due to higher supply from key producing countries and weaker demand for biofuel raw materials, especially in the U.S. Sugar prices fell as a result of weakening global demand and concerns about economic slowdown, along with forecasts of sugar production recovery in the 2025/2026 season. After increasing in the previous month, cereal prices fell in May, driven by declining corn and wheat prices. Corn prices fell sharply due to strong competition and crop availability from Argentina and Brazil, while expectations of a good 2025 harvest in the U.S. also contributed. Wheat prices declined due to weak global demand and improving crop conditions in the Northern Hemisphere. Late-month rainfall reduced drought risks in parts of Europe, the Black Sea region, and the U.S.

In contrast, meat prices rose the most in May due to higher prices for beef, lamb, and pork, driven by strong global demand, especially from China and Europe, and supply constraints related to climate and farming condition changes in some regions. Poultry prices fell due to bird flu-related import bans from Brazil, which caused a domestic surplus. Dairy prices increased across all products except skim milk powder. Butter prices remained historically high due to strong demand from Asia and the Middle East, though weaker demand for EU-origin butter limited further increases. Cheese prices rose for the second month in a row due to higher demand and limited availability in the EU caused by unfavorable weather and disease outbreaks earlier in the year. Whole milk powder prices rose due to strong purchasing, while skim milk powder prices fell due to large supplies from butter-producing regions.

Service prices increased on average by 0.1% in May, with minimal impact on the overall price level. The main upward influence in the services sector came from higher accommodation prices, linked to the start of the holiday season. Housing management fees also contributed. The largest downward effect came from lower prices for international flights and package travel services (trips abroad purchased from tour operators).

Other goods and services had little overall impact on price level changes in May.

In May 2025, compared to May 2024, consumer prices rose by 3.6%. The average annual inflation rate was 2.4%.