In October, consumer prices increased, but overall price changes were typical for the month. The rise was driven by higher energy prices, while the impact was dampened by weaker seasonal effects and lower food price pressure.

According to the latest data from the Central Statistical Bureau, in October 2025 consumer prices increased by 0.4% compared with September. Prices of both goods and services rose by 0.4%.

October is traditionally characterized by an increase in consumer prices, mainly driven by seasonal factors. This year, overall price growth was faster than in the previous two years, but more moderate than before the Covid-19 pandemic and the energy crisis, when October price increases typically ranged between 0.4% and 0.8%. The rise in prices was largely driven by higher district heating tariffs in Riga and several other municipalities, as well as increases in food, fuel and air transport prices, while it was restrained by lower prices for alcoholic beverages and personal care products. Food price growth in October this year was the lowest since 2020, when prices declined due to the Covid-19 crisis, and excluding that period, the lowest since 2014. Prices of essential food groups included in the memorandum on price reduction also increased slightly in October, mainly due to seasonal factors in the vegetable segment. It should be noted that the increase in fresh vegetable prices was very modest compared with previous years, indicating that this initiative continues to help curb food inflation pressure. At the same time, both the milder-than-usual food price increase and the atypical decline in clothing and footwear prices point to weaker seasonal effects.

In the goods sector, the largest upward impact in October came from higher prices for housing-related energy resources, which increased the overall consumer price level by 0.3 percentage points. Prices rose for all major types of energy resources except natural gas, where prices remained unchanged. The strongest impact came from a 4.4% increase in district heating prices, mainly due to the new AS “Rīgas Siltums” tariff coming into force on 1 October, as well as tariff increases in several other municipalities. With the heating season intensifying, electricity prices rose by 1.5% and solid fuel prices by 2.6%. The increase in electricity prices was driven by higher exchange prices, which affected tariffs linked to the electricity market. In addition to the heating season, price growth was also influenced by lower electricity generation from renewable energy sources (less solar and wind production) and reduced electricity flows from Nordic countries due to technical issues and connection maintenance.

Prices for food and non-alcoholic beverages increased by 0.5% in October, raising the overall consumer price level by 0.1 percentage points. The increase was mainly driven by higher prices for fresh vegetables, bread, fish and dairy products, while the strongest downward impact came from lower prices for oils, fats and pork.

Global food prices declined for the second consecutive month in October, falling by 1.6%, and were 0.3% lower year-on-year compared with October 2024. The decline was driven by lower prices for sugar, dairy products, meat and cereals, which outweighed the increase in vegetable oil prices. Sugar prices fell to their lowest level since December 2020 due to forecasts of sufficient global supply, including high production in Brazil and expected larger harvests in India and Thailand, as well as lower oil prices reducing demand for bioethanol. Dairy prices declined for the fourth consecutive month, with prices falling across all product groups, reflecting ample export supply from the EU and New Zealand, supported by favorable weather conditions and weak demand from Asia and the Middle East. Meat prices fell after eight months of growth, mainly due to lower pork and poultry prices. Pork prices declined due to ample supply and lower import demand from China following the introduction of new import duties on EU products. Poultry prices fell as Chinese trade restrictions related to avian influenza forced Brazilian exporters to redirect supplies to lower-priced markets. In contrast, beef prices continued to rise, supported by steady global demand. Cereal prices declined for the sixth consecutive month across all major groups due to favorable harvest prospects and sufficient global supply. Conversely, vegetable oil prices increased, with the index reaching its highest level since July 2022, driven by higher prices for palm, rapeseed, soybean and sunflower oils.

After two months of decline, fuel prices increased by 0.8% in October, raising the overall consumer price level by 0.05 percentage points. The increase was similar for both diesel and gasoline.

Meanwhile, oil prices on global markets declined overall in October. The average monthly Brent crude oil price fell by around 5% compared with September, and by the end of the month it was about 3% lower than at the end of September. Price dynamics were driven by opposing supply and demand factors: concerns about global oversupply and weakening demand continued to put downward pressure on prices, while geopolitical developments and sanction risks against Russia’s oil sector temporarily pushed prices higher. During the month, Brent crude prices fluctuated between USD 61 and 66 per barrel. At the beginning of the month, prices declined following the OPEC+ decision on a limited increase in production, which was smaller than expected but failed to alleviate concerns about high supply and weak demand growth. Downward pressure was further intensified by rising supplies from Venezuela, the resumption of oil flows from Kurdistan through Turkey, and inventory increases in the US and China. In mid-October, prices fell to a six-month low, driven by International Energy Agency forecasts of a growing market surplus and rising production in the US, Canada and Brazil, alongside downward revisions to demand forecasts. Toward the end of the month, volatility returned as US sanctions against Russia’s Rosneft and Lukoil caused a temporary price increase due to concerns over supply disruptions, but this effect was quickly offset by news of high oil production in the US and expectations of possible OPEC+ output increases, leaving Brent prices stabilizing around USD 65 per barrel at month-end.

A notable upward impact on the overall consumer price level also came from a 1.5% increase in prices for goods related to home furnishing and maintenance, which raised the overall price level by 0.05 percentage points. This was mainly driven by higher prices for cleaning and care products as well as household furniture.

The largest downward impact in October came from a 2.3% decline in alcoholic beverage prices, which reduced the overall consumer price level by 0.1 percentage points, affecting all types of alcoholic beverages except beer. The price decline was likely driven by lower seasonal demand after the summer period and retailers’ base price adjustments in response to reduced sales following the introduction of trading hour restrictions and increased market competition.

A significant price decline due to promotions was also observed for personal hygiene and beauty products, which fell by 4.1% in October, reducing the overall price level by 0.1 percentage points.

Clothing and footwear prices declined by 0.8% in October, which, as last year, is atypical for the month. This was likely influenced by weaker demand and earlier-than-usual autumn–winter season sales, indicating retailers’ efforts to boost sales in a competitive environment. Apart from last year, the only similar case in October was in 2021, when prices declined due to Covid-19 restrictions.

Overall, service prices increased by an average of 0.4% in October, raising the overall price level by 0.1 percentage points. The largest upward impact came from higher passenger air transport prices, likely driven by a reduced number of flights in the winter schedule, increased demand in mid-autumn (due to business travel and school holidays), and the end of promotional offers that airlines had provided in September to fill winter season capacity. Additional upward pressure came from higher outpatient medical service prices in specialist and dental care segments. The strongest downward impact on the overall price level came from lower accommodation prices, which continued to decline due to the end of the tourism season and reduced guest activity.

Price changes in other goods and service groups did not significantly affect the overall price level during the month.

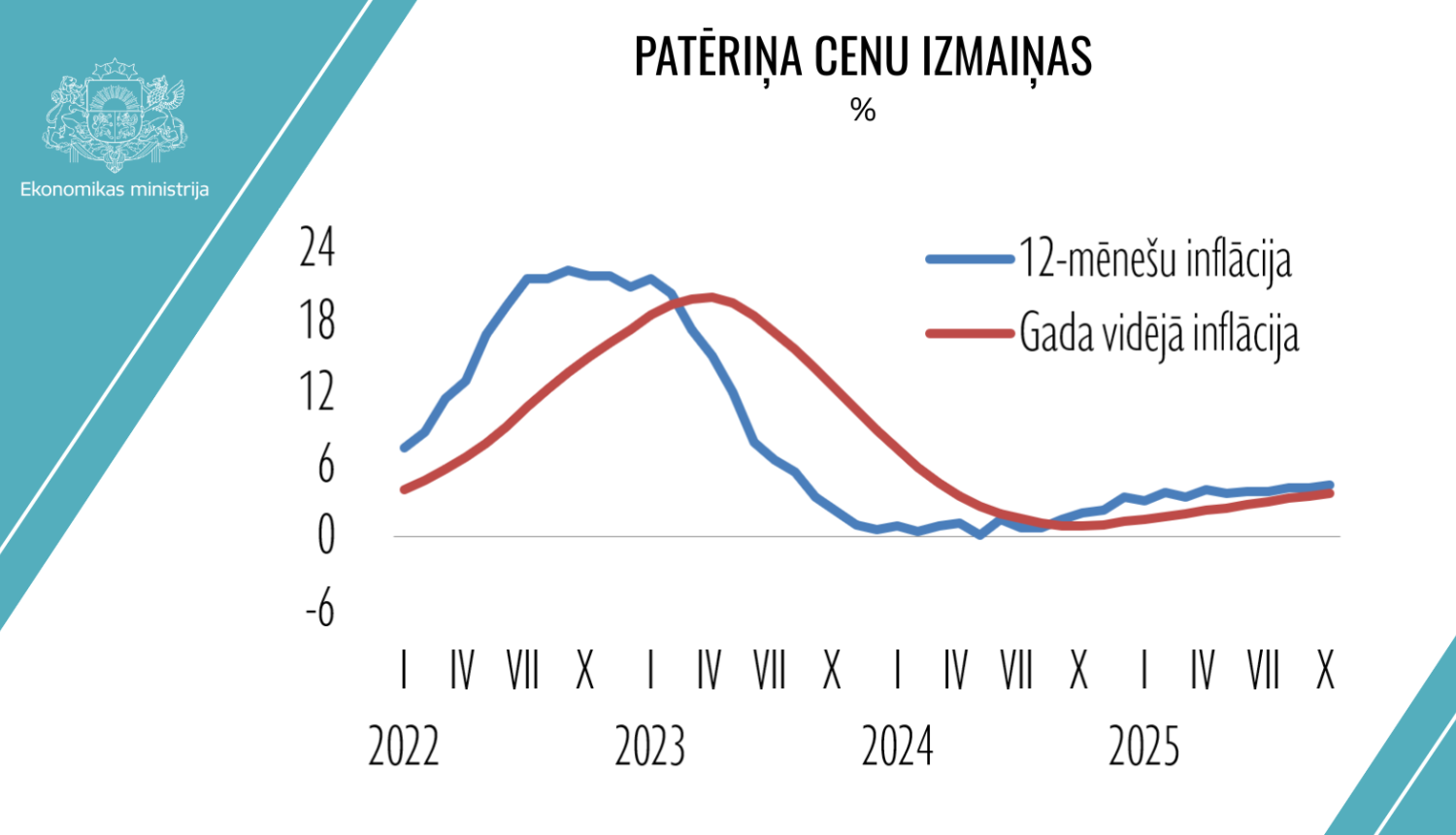

In October 2025, compared with October of the previous year, consumer prices increased by 4.3%. Average annual inflation stood at 3.6%.

Going forward, price developments in Latvia will continue to be significantly influenced by global price fluctuations and global economic conditions, particularly the geopolitical situation and its impact on energy and food prices. Overall, average annual inflation in 2025 is expected to be around 3.8%.