Translated using ChatGPT service.

Following May’s signs of slowing inflation, moderate price changes persisted in June, indicating a continuing trend of price stabilization. Moreover, excluding the price decreases observed over the past two years, June saw the lowest price increase since 2016. This time, food products were the main factor contributing to a reduction in overall consumer prices.

According to the latest data published by the Central Statistical Bureau, in June 2025 compared to May, the consumer price level rose by 0.1%. Prices for goods decreased by 0.3%, while service prices increased by 1.2%.

Typically, June sees a sharper price increase, mainly driven by seasonal food price rises. Considering that food price inflation has been one of the main drivers of inflation in recent years, the June data may indicate easing inflationary pressure. An additional positive effect may already be seen from the memorandum signed at the end of May between the state, producers, and retailers, aimed at reducing prices for essential food products — this could help stabilize food prices further.

However, overall price levels in June were pushed up by rising fuel prices, caused by increases in global oil prices, as well as higher service costs.

In the goods sector, the largest upward influence in June came from a 2.5% increase in fuel prices, which raised the overall consumer price level by 0.2 percentage points. Prices rose similarly for both diesel and petrol.

The average oil price rose significantly in June after declining for four consecutive months. The benchmark Brent crude price rose by about 9% in June compared to May, and by the end of the month was 5.8% higher than at the end of May. Price fluctuations were mainly driven by geopolitical tensions in the Middle East and developments in OPEC+ production policy. At the beginning and mid-June, Brent prices surged to around $77 per barrel – the highest level since February – due to escalating tensions between Iran and Israel, which raised concerns about possible disruptions to oil supply through the Strait of Hormuz, a key route for over one-fifth of global oil shipments. Although Iran’s oil infrastructure was not directly affected, markets reacted to the growing military tensions and speculation about potential U.S. involvement.

However, just a week later, the sharpest Brent oil price drop in the past two years was recorded – down to $67 per barrel (more than 13%) – due to easing regional tensions and increased expectations that OPEC+ might expand production by another 411,000 barrels per day in August, following a planned increase in July. The price drop was further reinforced by the International Energy Agency's confirmation of the availability of 1.2 billion barrels in strategic reserves, which could be used if needed. By the end of June, Brent prices remained mostly stable. Further downward pressure came from the U.S. President’s comments on potential sanctions relief for Iran, as well as investor caution ahead of the July 9 deadline set by the U.S. administration for concluding trade agreements.

The largest downward influence in June came from falling food prices. Prices for food and non-alcoholic beverages decreased by 0.5%, which reduced the overall consumer price level by 0.1 percentage points. A June decline in food prices was last observed in 2020 due to the COVID-19 crisis, and before that in 2016. This year, the main contributors to the drop were fresh vegetables, bread, and dairy products, while the biggest upward impact came from meat.

Globally, food prices rose by 0.5% in June after declining the previous month. Year-on-year (compared to June 2024), food prices increased by 5.8%. The price increases for dairy, meat, and vegetable oils outweighed the declines for sugar and cereals. The sharpest increase was in vegetable oils, driven by higher prices for palm, soybean, and rapeseed oils. Prices rose due to global import demand, expectations of biofuel sector growth in Brazil and the U.S., and a predicted shortage of rapeseed oil. Sunflower oil prices fell slightly due to good harvest forecasts in the Black Sea region.

Meat prices rose sharply across all categories except poultry. Beef prices increased due to a drop in exports from Brazil and high demand in the U.S. Pork and lamb prices rose due to stable demand and limited supply. Poultry prices declined due to large stockpiles and export restrictions in Brazil following a bird flu outbreak, but partially recovered by the end of the month after restrictions were lifted.

Dairy prices rose moderately in June, with butter prices reaching a new record high, driven by low supply in Oceania and the EU and strong demand from Asia. EU dairy production was limited by environmental regulations and disease outbreaks, while butter production and inventories fell in the U.S. Cheese prices rose for the third consecutive month, while skimmed and whole milk powder prices fell due to weak demand and large inventories.

The sharpest decline in June was for sugar prices — the index reached its lowest level since April 2021. The fall was due to improved harvest forecasts: dry weather and more sugarcane in Brazil, and earlier, more intense monsoon rains and expanded sowing areas in India and Thailand. Cereal prices dropped for the second month in a row, mainly due to falling maize prices caused by increased competition from Argentina and Brazil. In contrast, wheat prices rose due to poor weather in key growing regions — Russia, the EU, and the U.S.

Another downward influence in June came from falling housing-related energy prices, which lowered the overall price level by 0.1 percentage points. The largest effect came from a 1.3% drop in electricity prices, due to lower exchange prices. Notably, in June, the average electricity price on the Nord Pool exchange reached its lowest level since December 2020. Prices also declined for solid fuels (by 1.4%) and thermal energy (by 0.7%).

Due to seasonal discounts, prices for clothing and footwear dropped by 1%, which reduced the overall consumer price level by 0.1 percentage points.

Service prices rose on average by 1.2% in June, increasing the overall price level by 0.3 percentage points. The biggest impact came from seasonally rising prices for travel and leisure services – international flights, package holidays from tour operators, as well as accommodation and dining services. Other significant contributors were rising telecommunications prices, higher outpatient healthcare costs (mainly due to dentistry), increased prices for housing maintenance and repair services, and higher rents. The largest downward influence came from falling insurance prices.

In other goods and services categories, price fluctuations did not significantly affect the overall price level.

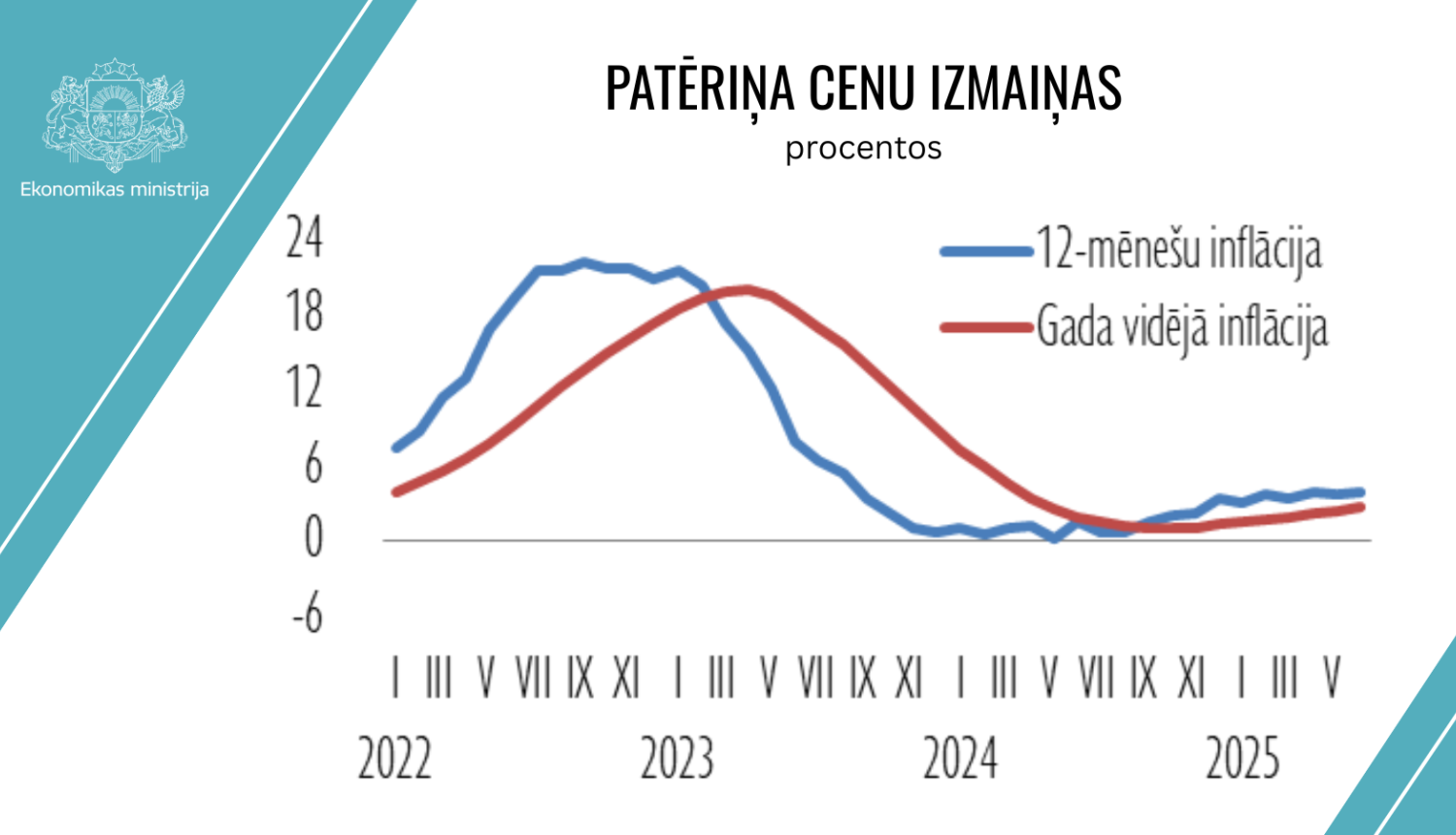

In June 2025, compared to June of the previous year, consumer prices rose by 3.8%. The average annual inflation rate was 2.7%.

Looking ahead, global price fluctuations and global economic developments will continue to have a significant impact on price changes in Latvia – particularly geopolitical developments and their effect on energy and food prices, as well as U.S. trade policy. Overall, the average annual inflation in 2025 is expected to be higher than in 2024 and could exceed the 3% threshold.