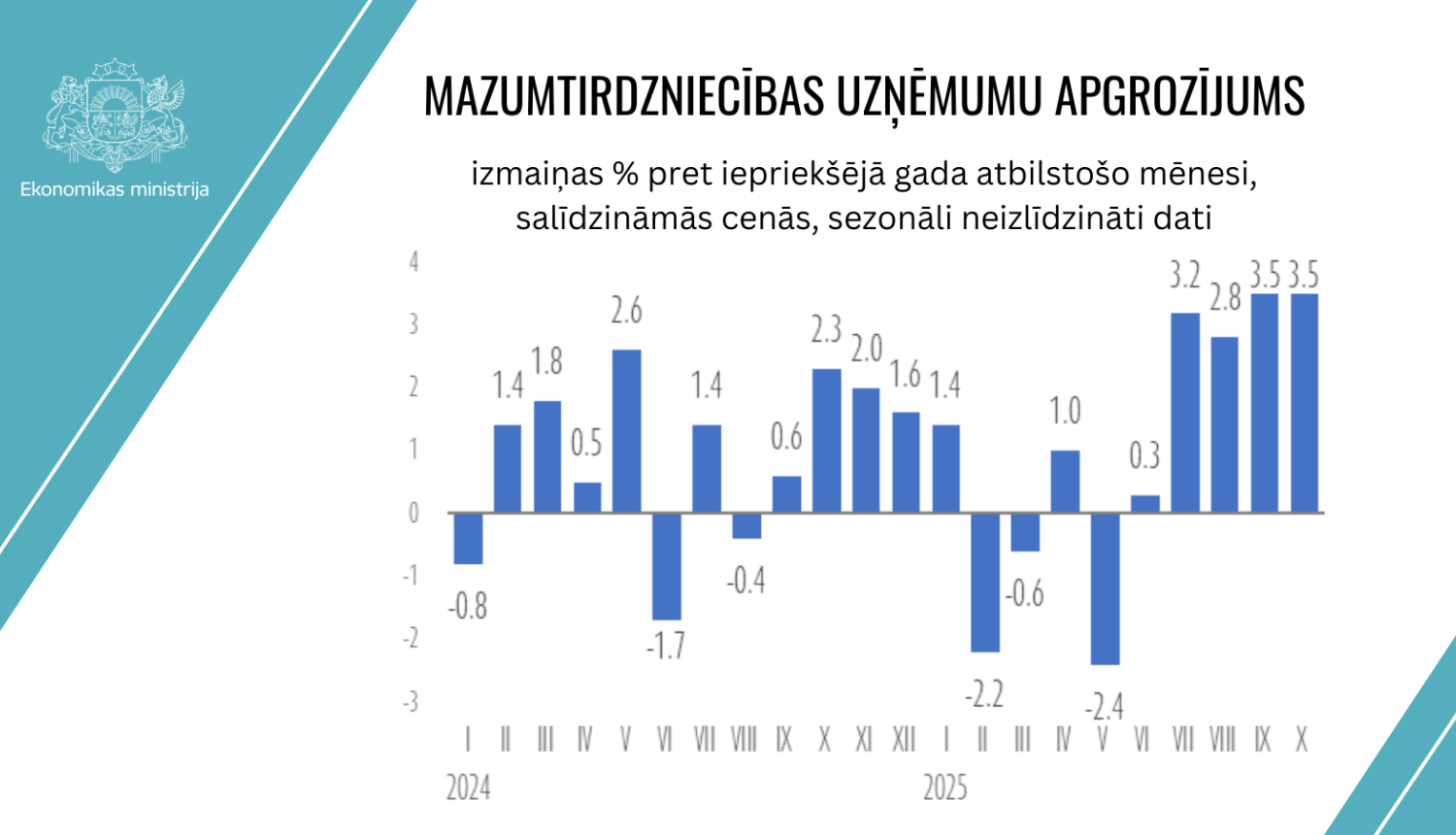

In October 2025, retail turnover continued to grow, maintaining a moderate growth trend. Over the year, the total turnover of retail enterprises at constant prices increased by 3.5% according to unadjusted calendar data, and by 4.8% according to seasonally adjusted data.

As in previous months, growth was mainly driven by non-food retail trade, while the food segment recorded a slight increase in turnover after nearly a year of stagnation. Significant growth also continued in fuel retail, with volumes rising for the second consecutive month. Month-on-month, retail turnover also increased—by 1.2% in October compared with September (seasonally adjusted), driven by growth in non-food and fuel sales, while food retail remained almost unchanged, reflecting stable everyday consumption.

Overall, retail trade continues along a path of moderate growth. In the short term, this will be supported by rising purchasing power and more stable incomes, although high prices, caution, and more frugal consumer habits will continue to limit faster growth. The October data indicate a gradual and increasingly balanced expansion of demand, with the growth foundation increasingly based on real consumption rather than statistical base effects. While growth remains moderate, it encompasses non-food goods, fuel, and, after a long pause, also food. The non-food segment continued to be the main driver of growth in October, maintaining a steady growth pace supported by improved consumer sentiment and more active seasonal purchases of specific product groups. The very moderate increase in the food segment indicates stabilization, with price pressures easing and consumer spending becoming more resilient.

In October, compared with October 2024, non-food retail turnover rose by 5.8%, with growth observed in almost all major non-food categories, except textiles, carpets, floor coverings, wallpapers, furniture, lighting, and other household goods, where turnover fell by 5.7%, and cosmetics and toiletries, which declined by 1.1%. The fastest growth was recorded in household electrical appliances in specialized stores (+16.0%) and information and communication technology equipment (+14.7%). Strong increases were also seen in pharmaceutical and medical supplies (+11.6%) and sporting goods and games retail (+11.0%). Higher turnover was also observed in flowers, plants, seeds, fertilizers, pet animals, and pet food (+6.0%), while more moderate growth occurred in clothing, footwear, and leather goods (+2.3%), watches, jewelry, and other new goods (+1.7%), and metal products, tools, building materials, and plumbing retail (+1.4%). Turnover remained unchanged for books, newspapers, stationery, and audio and video recordings.

Food retail turnover increased by 0.3% year-on-year in October, marking the first growth since November 2024. This increase can only partly be explained by the base effect; a significant role was also played by more resilient demand and reduced price pressures. Growth was mainly driven by turnover in non-specialized stores, which primarily sell food products. Consumers still prefer large stores with a wider product range and more competitive prices, while turnover in specialized food stores continued to decline.

Fuel retail turnover at filling stations rose by 3.1% in October compared with October 2024, marking the second consecutive month of significant growth. The increase was supported by slightly lower fuel prices compared with last year and, most likely, higher vehicle traffic and more active economic activity after the summer season.

By retail location outside of stores, turnover declined in October compared with the same period last year, both in stand and market retail (-2.4%) and in mail-order or online retail (-2.7%). This decline can be partly explained by the high comparison base for online trade, which grew significantly last October, as well as consumers’ preference for shopping more frequently in large stores. In contrast, turnover in other retail outside stores, stands, and markets increased significantly (+27%), driven by a very low base from last year, when turnover in this segment fell sharply, and possibly by increased activity in specialized mobile or pop-up retail services.

Overall, from January to October this year, retail turnover increased. Compared with January–October 2024, it was 1.1% higher. This was largely driven by the growth in non-food retail turnover (+4.0%). Food retail turnover decreased by 2.2%, while fuel retail turnover declined slightly by 0.2%.