Translated using ChatGPT service.

In the coming months, retail turnover is likely to remain volatile; however, the overall trend will be towards gradual growth.

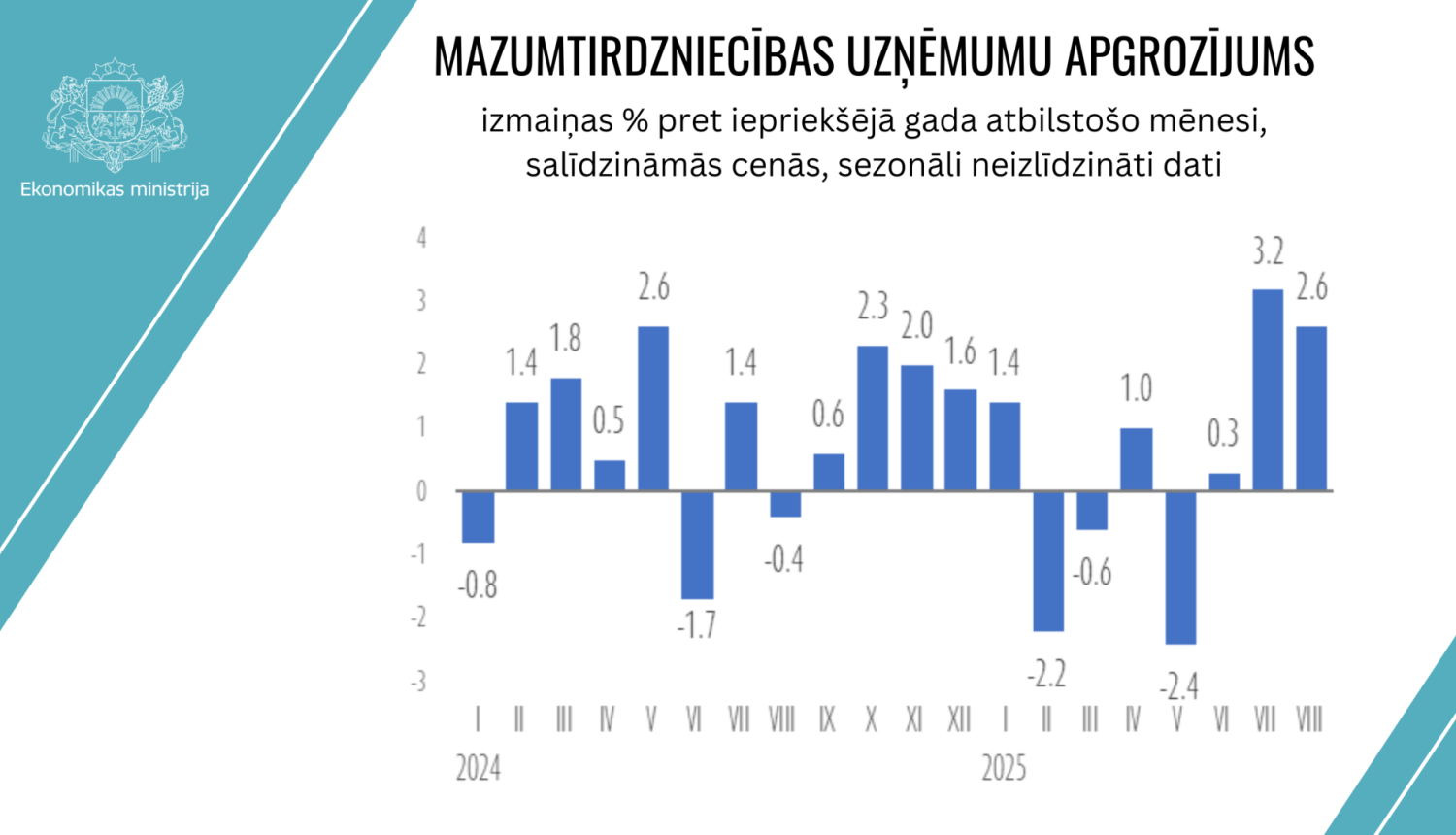

In August 2025, retail turnover continued to increase. Year-on-year, the total turnover of retail enterprises at constant prices grew by 2.6% (according to non-adjusted data). Growth was supported by a significant increase in non-food trade, as well as by the fact that retail turnover in August 2024 was particularly low, making this year’s rise appear more pronounced in comparison. Month-on-month, retail volume also increased – in August, compared with July, it rose by 1.0% (seasonally adjusted), driven by higher non-food turnover.

In the coming months, retail turnover is likely to remain volatile, but the overall trend will be gradually upward. The annual increase in August was driven by the rise in non-food trade, supported both by the low base of comparison and by consumers’ improved sentiment regarding larger purchases. In the food segment, the decline in turnover was small, as the price-reduction initiatives implemented by major supermarkets kept consumption stable and reduced the impact of high prices on household budgets. Fuel sales decreased despite lower prices, most likely due to more moderate and economical travel patterns. As pressure on essential goods eases, households retain opportunities to allocate more funds to non-food segments, although the high price level will remain an important factor limiting a faster rise in consumption.

In August, compared with the same month a year earlier, non-food retail turnover increased by 6.4%. It rose in all major non-food product groups except cosmetics and toiletries, where turnover fell by 3.5%. Year-on-year, retail turnover in August increased most rapidly in sports goods and games (by 18.4%) and in household electrical appliances sold in specialised stores (by 17.1%). Strong growth was also recorded in the retail trade of watches, jewellery and other unclassified new goods (by 11.6%), flowers, plants, seeds, fertilisers, pet animals and pet food (by 9.8%), metal products, tools, building materials and plumbing supplies (by 8.6%), clothing, footwear and leather goods (by 7.9%), pharmaceutical and medical supplies (by 6.7%), textiles, carpets, floor coverings, wallpapers, furniture, lighting and other household goods (by 6.0%), and books, newspapers, stationery, audio and video recordings (by 5.1%). Growth was more moderate in information and communication technology equipment sales (up 1.6%).

Food retail turnover declined moderately year-on-year – by 0.9%. This was determined by the increase in turnover volumes in non-specialised retail stores selling mainly food, beverages or tobacco (i.e., supermarkets) and by the low base in August 2024. Shoppers increasingly choose supermarkets offering a wider basket of lower-priced goods, while specialised food stores continued to experience a sharp drop in turnover. This indicates that the downward trend in the prices of essential goods continued in August, reinforced by the price-reduction initiatives (memorandum) implemented by major retail chains. Therefore, the decline in turnover remained limited and mainly reflected lower price levels for frequently purchased goods rather than weakened consumption, as households purchased the same amount or even more food in physical volumes.

Fuel retail turnover at fuel stations decreased in August – by 0.6% compared with August 2024, even though fuel prices were slightly lower than a year earlier. This was likely caused by reduced fuel consumption, more economical driving habits and more moderate travel activity.

By type of retail outlet, turnover growth in August compared with the same period a year earlier was observed in retail trade at stalls and markets (up 5.9%), but declined in other retail trade outside stores, stalls and markets (down 1.3%) and in mail-order or internet retail (down 4.1%).

Overall, in January–August of this year, retail turnover increased. Compared with January–August 2024, it was 0.5% higher. This was largely driven by a 3.4% increase in non-food retail turnover. Food retail turnover fell by 2.7%, while fuel retail turnover decreased by 1.0%.