Translated using ChatGPT service.

In September, consumer prices rose, but the increase was one of the most moderate in recent years, driven by weaker seasonal effects and lower pressure from food and energy prices.

According to the latest data published by the Central Statistical Bureau, in September 2025, compared to August, the overall consumer price level increased by 0.2%. Prices for goods rose by 0.3%, while service prices remained unchanged.

September is traditionally a month when consumer prices increase, mainly due to the rise in clothing and footwear prices as the new autumn–winter collections reach stores. This year, seasonal price changes were observed as usual, but the increase in clothing and footwear prices was unusually moderate, indicating weaker seasonal effects. Additionally, inflation was influenced by falling fuel prices, driven by global oil price dynamics, and cheaper household appliances and everyday maintenance products. In the services sector, price increases in education, housing-related services, and outpatient medical services were balanced by price decreases in transport and accommodation services. This year, the typical September drop in food prices did not occur – prices remained nearly unchanged due to local weather conditions and limited vegetable supply, so food prices did not significantly affect overall inflation. Meanwhile, for product groups included in the memorandum on reducing essential food prices, prices continued to decline, indicating that this initiative still helps reduce inflationary pressure on food.

In the goods sector, the largest upward impact in September came from clothing and footwear price increases, though it was the slowest September increase for clothing and footwear since 2000. During the month, clothing and footwear prices rose by 3.2%, contributing 0.2 percentage points to the overall consumer price level increase.

Small price increases were also observed for food and non-alcoholic beverages, alcoholic beverages and tobacco, as well as housing-related energy resources, which together raised the overall consumer price level by 0.1 percentage points. The increase in the alcoholic beverages and tobacco group was driven by a slight rise in alcoholic beverage prices, while in the housing group it was due to higher electricity costs.

Food and non-alcoholic beverage prices increased by 0.1% in September. The largest upward effects came from rising prices for coffee, poultry, dried, salted, or smoked meat, and milk, while the largest downward effects were due to falling prices for cheese and curd, potatoes, and fresh fruits. Notably, fresh vegetable prices, which usually decline in September, remained practically unchanged this year.

Globally, food prices decreased by 0.7% in September, but over the year, compared to September 2024, they increased by 3.4%. The September decline was driven by falling prices for cereals, dairy products, sugar, and vegetable oils, which outweighed the rise in meat prices. Sugar prices fell to their lowest level since March 2021 due to higher-than-expected production in Brazil, where both sugarcane processing and sugar production increased. Additional price pressure came from favorable harvest forecasts in India and Thailand, supported by abundant rainfall and expanded sowing areas. Dairy product prices fell for the third consecutive month. The steepest decline was in butter, due to seasonal increases in cream supply, reduced demand for ice cream in the Northern Hemisphere, and higher production forecasts in New Zealand. Milk powder prices fell due to weaker demand. Cheese prices fell only slightly – small declines in the EU market were offset by higher demand in Oceania, where limited supply and active Asian buyers supported prices. Vegetable oil prices decreased as the drop in palm and soybean oil prices outweighed increases in sunflower and rapeseed oils. Palm oil prices fell slightly as stocks in Malaysia reached a 20-month high, while soybean prices decreased due to increased supply in Argentina, where export taxes were temporarily lifted. Meanwhile, sunflower oil prices rose due to limited supply in the Black Sea region, and rapeseed oil prices increased due to supply shortages in Europe. Cereal prices fell for the fifth consecutive month. Wheat prices decreased due to weak demand and abundant harvests in Russia, Europe, and North America, while corn prices fell due to anticipated good harvests in Brazil and the US, and the temporary removal of Argentina's cereal export taxes further lowered prices. In contrast, the meat price index reached a new record in September, driven by rising beef and lamb prices, while pork and poultry prices remained nearly unchanged. Beef prices reached historic highs due to strong US demand – limited domestic supply and favorable price differentials continued to increase imports, particularly from Australia, where prices also rose. In Brazil, beef prices increased due to strong global demand, which compensated for market access restrictions in the US after tariff increases. Lamb prices rose due to limited supply in Oceania. Pork prices remained stable, as reduced Chinese purchases balanced demand from other markets, and new Chinese tariffs in the EU had no significant impact. Poultry prices remained steady, although some import restrictions due to avian influenza outbreaks slightly affected trade.

The largest downward impact in September came from fuel prices, which fell by 1.1%, reducing the overall consumer price level by 0.1 percentage points. Prices decreased similarly for both diesel and petrol.

Oil prices remained largely stable in September. The average monthly Brent crude price increased by around 0.6% compared to August, but by the end of the month it was 1.6% lower than at the end of August. Price dynamics in September were determined by opposing factors – geopolitical risks and supply concerns pushed prices up, while weaker demand and increasing production restrained them. During the month, Brent crude prices fluctuated between $66–70 per barrel. At the beginning of the month, prices rose due to concerns about Russian supply disruptions and positive data from China indicating a recovery in manufacturing activity. However, expectations of possible OPEC+ production increases and signs of surplus risks limited the rise. Mid-month, downward pressure came from rising US inventories and weaker fuel demand forecasts, while in the second half of September, oil prices partially recovered following renewed attacks on Russia’s energy infrastructure in Ukraine and reduced US inventories, which raised supply concerns. Overall, these factors balanced each other, keeping prices relatively stable throughout the month.

Significant downward pressure also came from prices of household equipment and maintenance goods, which fell by 1.5%, reducing the overall consumer price level by 0.05 percentage points. The largest impact was from falling prices for cleaning and care products.

Service prices remained stable overall in September. The largest upward impact on consumer prices came from higher education services, related to the start of the new academic year and increased tuition fees. Additional upward pressure came from rising tariffs for water supply and sewerage services, as well as higher outpatient medical service costs in specialist and dental care segments. The largest downward impact on overall prices was from falling passenger transport costs, which decreased for air, road, and sea transport, with the biggest decline in air transport due to reduced seasonal demand. Accommodation prices also fell significantly in September, reflecting the end of the tourist season and lower hotel occupancy, despite the European Basketball Championship games in Riga during the first half of September, which only temporarily increased hotel activity.

Price fluctuations in other goods and services in the past month had no significant impact on the overall price level.

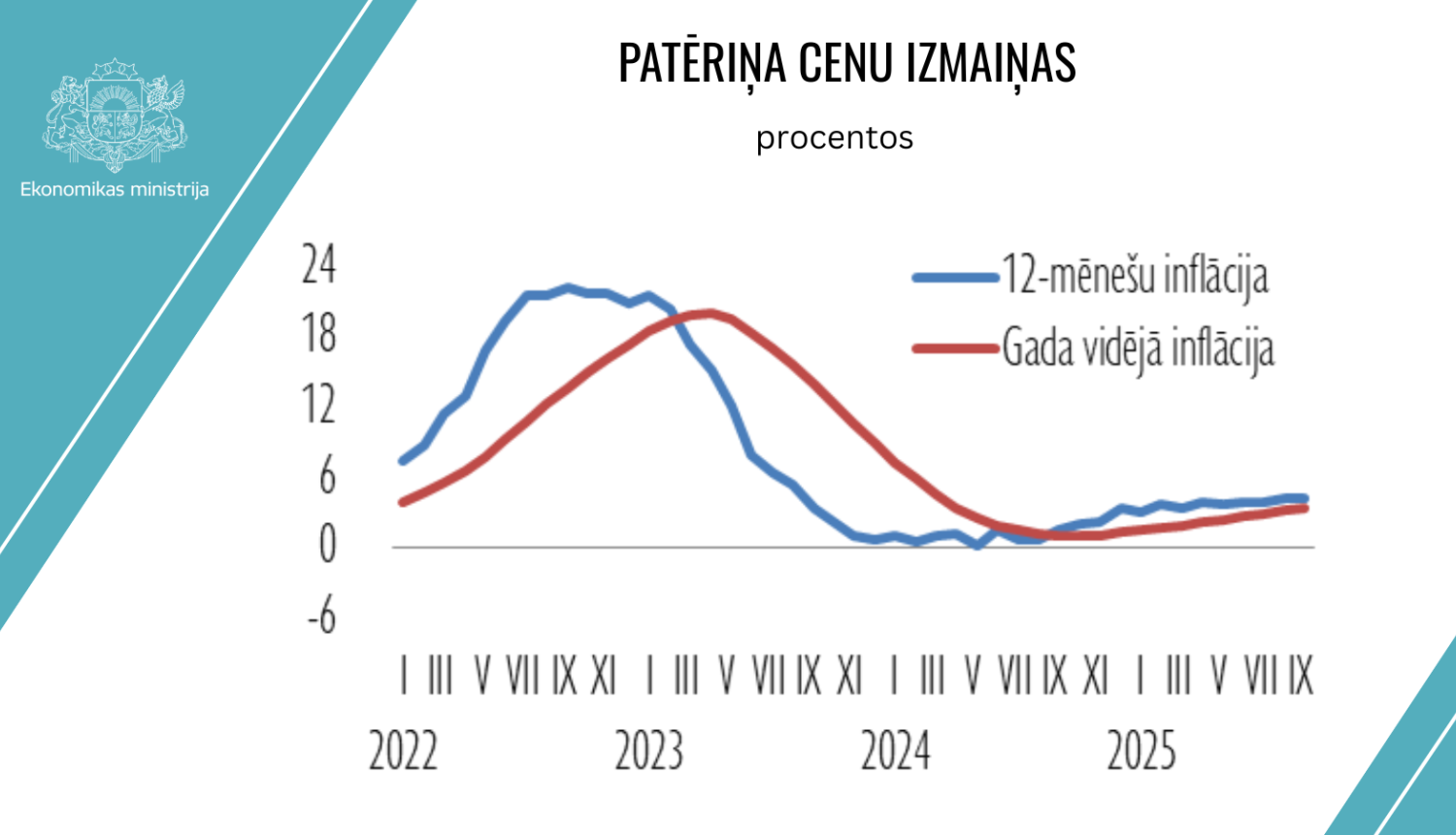

In September 2025, compared to September 2024, consumer prices increased by 4.1%. The average annual inflation was 3.4%.

Looking ahead, price changes in Latvia will continue to be significantly influenced by global price fluctuations and the development of the world economy, especially the geopolitical situation and its impact on energy and food prices. Overall, average annual inflation in 2025 is expected to be in the range of 3.5–4%.