In June of this year, retail trade turnover experienced a slight year-on-year increase. Faster growth was dampened by a decline in food and fuel sales, while it was supported by an increase in non-food product turnover.

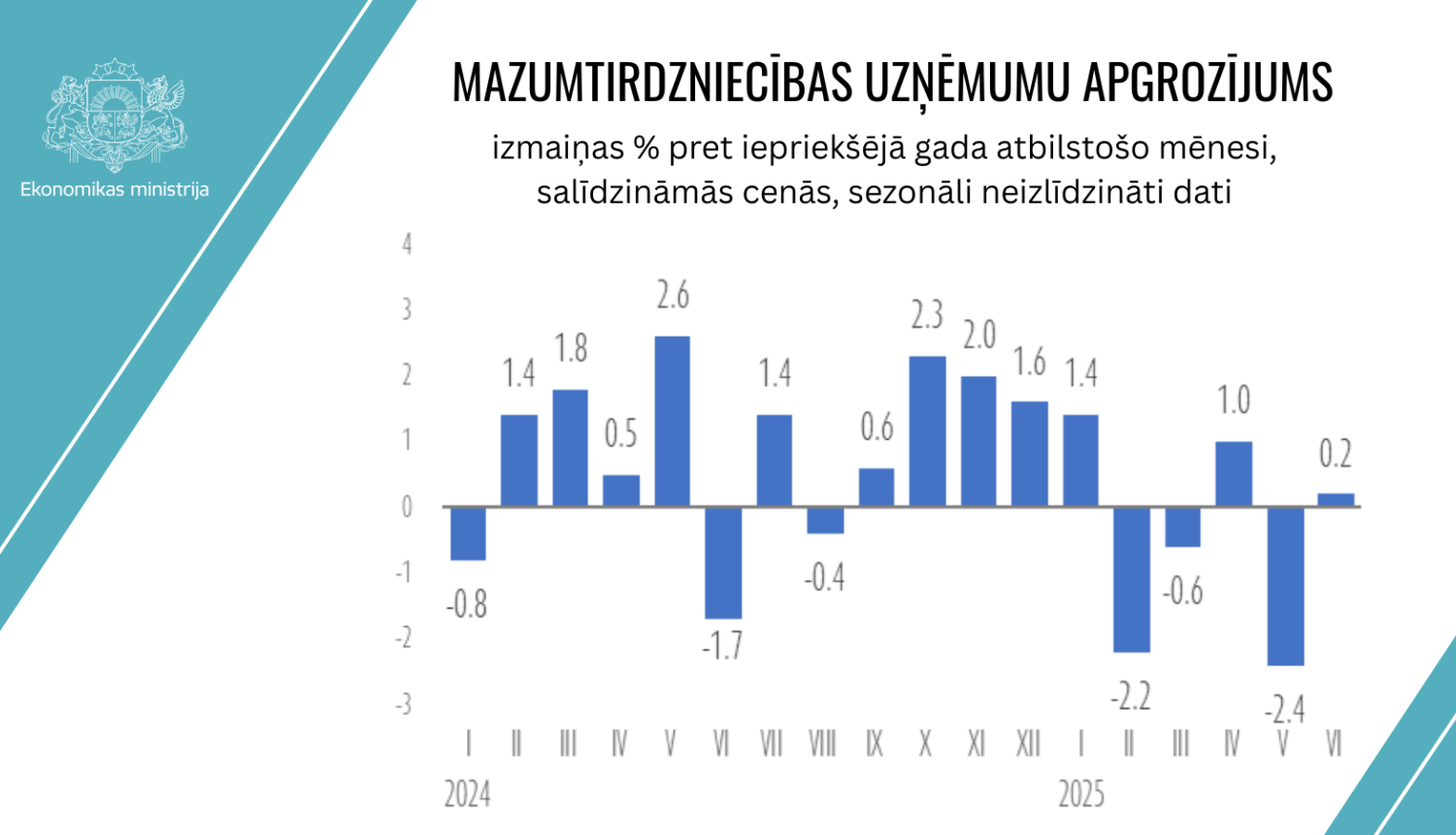

After a decline in May, retail trade turnover in June 2025 rose slightly compared to June of the previous year – by 0.2% (based on unadjusted data). On a monthly basis, retail trade volume also increased – in June compared to May it rose by 0.7% (seasonally adjusted data), driven by higher turnover of non-food products.

In the coming months, retail trade turnover is likely to remain volatile, yet overall will gradually move towards moderate growth. Consumption will continue to be supported by rising household incomes and lower interest rates, while the decline in food prices will allow households to reassess their spending structure and allocate more funds for other purchases. This trend already appeared in June when, despite declines in food and fuel segments, non-food product sales recorded a notable increase. However, overall consumption activity remains constrained by the high price level, which continues to weigh on household budgets.

In June, compared to the same month of the previous year, non-food retail turnover increased by 4.4%. It grew across all major non-food product groups except textiles, carpets, floor coverings, wallpapers, furniture, lighting equipment and other household goods (down by 9.2%), and books, newspapers, stationery, audio and video recordings (down by 5.7%). Sales of cosmetics and toiletries remained virtually unchanged (down by 0.2%). Retail turnover in June compared to the same period of the previous year increased most rapidly in household electrical appliances in specialized stores (up 13.4%) and information and communication technology equipment (up 11%). Strong growth was also observed in flowers, plants, seeds, fertilizers, pets and pet food (up 7.3%), pharmaceutical and medical goods (up 7.1%), watches, jewellery and other miscellaneous goods (up 5.7%), metal products, tools, construction materials and plumbing (up 5.1%), and sporting goods and games (up 5%). More moderate growth was recorded in clothing, footwear and leather products (up 2.6%).

Food retail turnover declined sharply year-on-year – by 4%, largely due to the still high price level that continues to restrain consumption. At the same time, June also saw a slight decrease in prices of essential goods, which may have reduced total turnover in nominal terms (euros), even if households purchased the same or even larger physical volumes of food. Thus, the decline in turnover does not necessarily indicate weaker consumption, but rather reflects lower prices for frequently purchased goods.

Fuel retail turnover at filling stations decreased in June – by 2.2% compared to June 2024, despite lower fuel prices. This was likely influenced by lower fuel consumption, more economical driving habits and more moderate travel activity.

By type of outlet, turnover decline in June compared to the same period of the previous year continued in retail trade at stalls and markets (down by 3.9%), while increasing in other retail trade outside shops, stalls and markets – by 1.4%. A slight decrease was observed in retail trade via mail order or the internet (down by 0.3%).